How a PEO Works for Small Businesses?

A Professional Employer Organization (PEO) is a company that provides HR services and employee benefits to small businesses. Essentially, a PEO becomes the employer of record (POR) for the small business’s employees, handling tasks such as payroll, taxes, and benefits administration. This allows the business owner to focus on running their business, while the PEO takes care of the HR tasks. The PEO model can also provide cost savings for startup businesses, as they can take advantage of the PEO’s economies of scale when it comes to benefits and insurance.

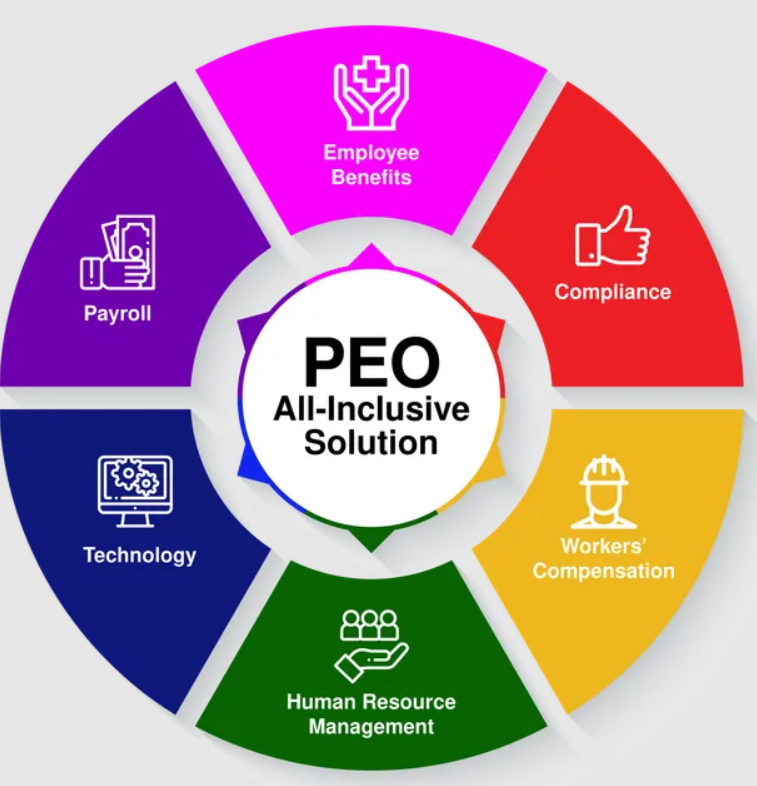

In addition to handling HR tasks, a PEO can also provide guidance and support on compliance with employment laws and regulations. This can be especially helpful for small businesses that may not have the resources or expertise to navigate complex HR and legal issues. By partnering with a PEO, small businesses can access a range of HR services and benefits that they may not be able to provide on their own, such as health insurance, retirement plans, and employee training programs. Overall, a PEO can be a valuable resource for startup businesses looking to streamline their HR operations and provide competitive benefits to their employees.

How does a PEO work?

A Professional Employer Organization (PEO) works by entering into a co-employment relationship with a business. This means that the PEO becomes the employer of record for the small business’s employees, while the small business remains in charge of day-to-day operations and management. The PEO handles HR tasks such as payroll, taxes, and benefits administration, while the small business retains control over hiring, firing, and employee supervision. The PEO model can provide cost savings for businesses, as they can take advantage of the PEO’s economies of scale when it comes to benefits and insurance.

When a small business partners with a PEO, the PEO takes on many of the administrative tasks that can be time-consuming and complex for business entities. This includes managing payroll, handling taxes, and providing employee benefits such as health insurance and retirement plans. By outsourcing these tasks to a PEO, small businesses can focus on their core operations and growth strategies. Additionally, PEOs can often negotiate better rates for benefits and insurance due to their larger pool of employees, which can result in cost savings for small businesses. Overall, the PEO model can be a valuable resource for businesses looking to streamline their HR processes and reduce costs.

What services do PEOs offer?

In addition to the services mentioned above, PEOs can also offer HR consulting and support, such as creating employee handbooks and policies, conducting HR audits, and providing guidance on HR best practices. PEOs can also help with risk management, such as implementing safety programs and managing workers’ compensation claims. Overall, PEOs provide a comprehensive solution for startups to manage their HR needs, allowing them to save time and money while also providing their employees with top-notch benefits and support.